do you pay capital gains tax in florida

In Florida you are required to pay documentary stamp taxes on the transfer of real estate for any consideration. In fact there are many states known for higher taxes such as California that also do not have an estate tax.

The Average Household Income In America Financial Samurai

There is no gift tax in Florida.

. Special Real Estate Exemptions for Capital Gains. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. If you earn money from investments youll still be subject to the federal capital gains tax.

The amount that can be excluded stands at 250000 for an individual and 500000 for a married couple. The only states with no additional state tax on capital gains are. You dont have to pay capital gains tax until you sell your investment.

Florida doesnt have condition tax meaning theres also no capital gains tax in the condition level. Second if you sell your home there may be a capital gains tax on the profit realized from the. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida.

2 Inheriting at death is good because of stepped up basis. The two year residency test need not be. Ncome up to 40400 single80800 married.

Florida used to have a gift tax but it was repealed in 2004. Generally speaking capital gains taxes are around 15 percentfor US. This means that eligible military members may exclude their capital gains as long as they occupied the primary residence for two of the previous 15 years.

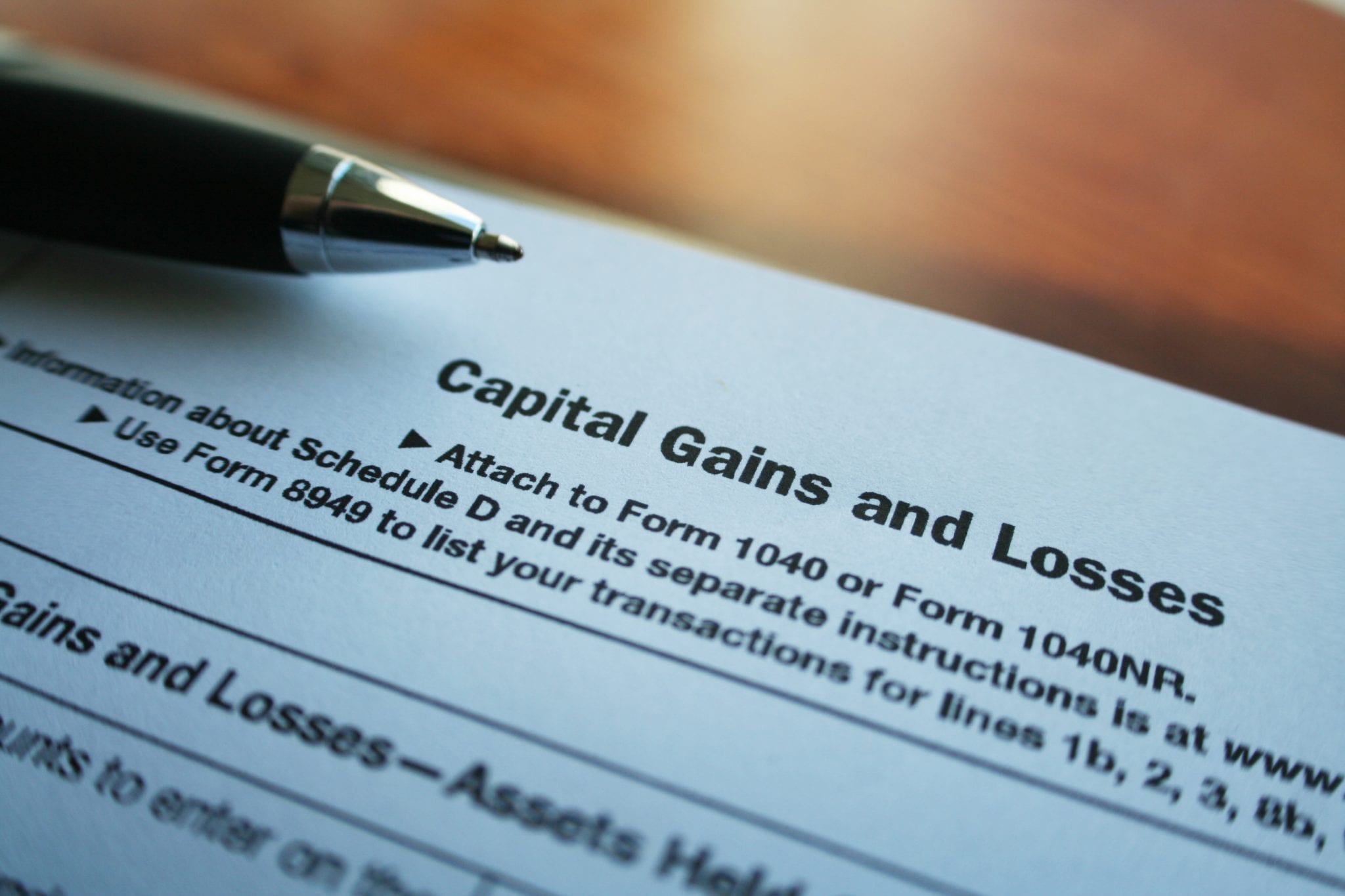

If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis. You have to pay taxes on the 100000 gain. For short-term properties youll pay the same tax rate as you.

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax. They are Washington Nevada Texas Wyoming South Dakota Tennessee Florida Alaska and New Hampshire. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules.

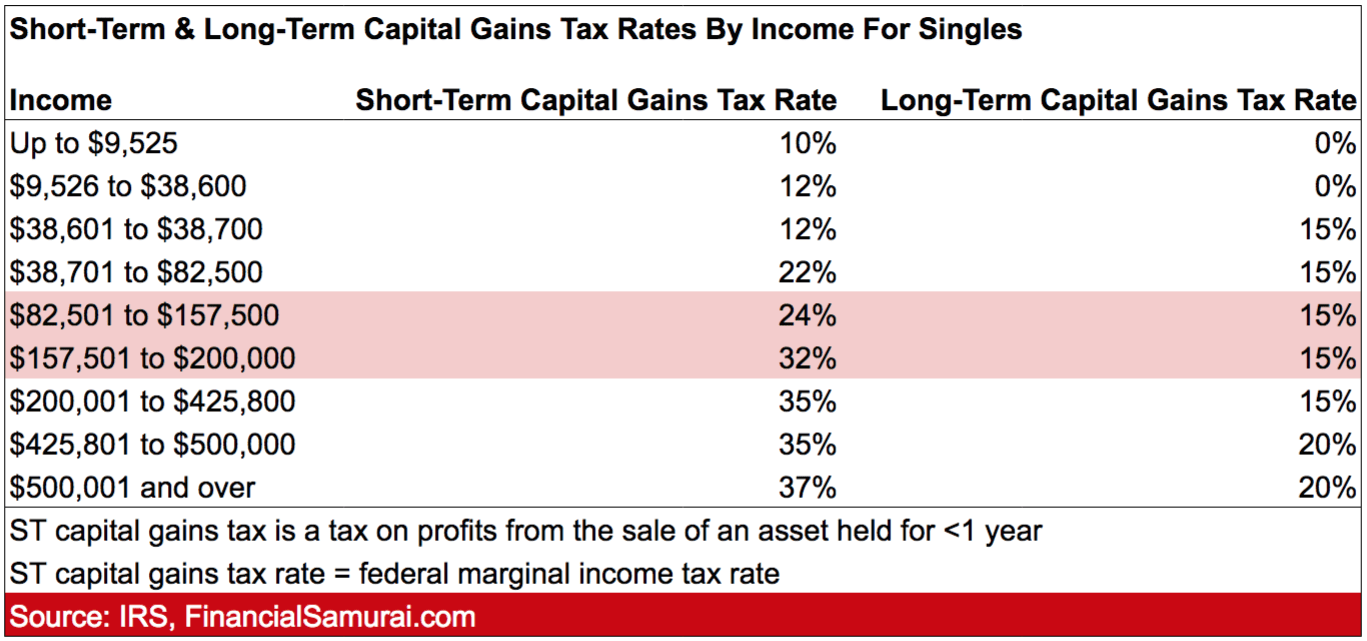

Typically can exclude 250000 from your tax return and up to 500000 if. The top federal long-term capital gains rate is 20 which is lower than all but two of the seven ordinary income tax rates. The other long-term capital gains tax rates are 0 and 15.

Do you have to pay tax on capital gains on a second home. There are only nine states without capital gains taxes. Residents is 15-20.

First all properties in Florida are assessed a taxable value and owners pay an annual Florida property tax based on this value except churches schools government entities. You may even be able to incorporate several of these taxation loopholes to maximize your benefit. Simply put if you use a lady bird deed all capital gains on the deeded property are eliminated on the day you die.

The tax paid covers the amount of profit the capital gain you made between the purchase. Your primary residence can help you to reduce the capital gains tax that you will be subject to. Mom dies in 2012 when the house was worth 100000 and you inherit the house.

Capital Gains Tax Exemption. Residents living in the state of Florida though there are those who can see a long-term capital gains tax rate as high as 20. This amount increases to 500000 if youre married.

If youve owned it for more than two years and used it as your primary residence you wouldnt pay any capital gains taxes. You have lived in the home as your principal residence for two out of the last five years. Generally speaking capital gains taxes are around 15 percent for US.

The capital gains tax rate is high and its just one of the taxes property owners may have to pay when selling. In Florida theres no condition tax as theres in other US states. You sell the house you inherit 6.

Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming. Gift Tax in Florida. The credit is generally limited to your resident state tax rate.

Again this varies based on whether the money comes from short-. Doc stamps on the deed. This tax is paid to the local municipality.

However its possible that you qualify for an exemption. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida. On the other hand most states including Florida do not impose any estate tax.

Income over 40400 single80800 married. There are also ways to offset the costs of your capital gain so that even if you do have to pay the tax it can be minimized. The Taxes On Selling Real Estate.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. At what age do you stop paying property taxes in Florida. Residents living in the state of Florida though there are those who can see a long-term capital gains tax rate as high as 20.

Lady bird deeds do not result in any documentary stamp taxes when you execute the deed. Further your resident state will generally tax all of your income but will allow a credit for the tax paid to the other state. Take advantage of primary residence exclusion.

For example the main city gains rate for US. Say for example your resident state tax rate is 5 percent but you paid 6 percent in the state where the property was located. When selling your house in Florida you can exclude a high portion of your profits given specific conditions are met.

Should you make money using investments youll be susceptible to the government capital gains tax. When do you not have to pay taxes on capital gains in Florida. However its possible that you qualify for an exemption.

Mom dies and leaves you a home worth 200000. When you sell a rental property you may have to pay capital gains taxes and recaptured depreciation taxes technically called unrecaptured section 1250 gain. Income over 445850501600 married.

Any amount exceeding these numbers is taxed at 20 percent which is down from the previous tax amount of 28 percent. Here is a. You can exclude a portion of profits when selling your Florida house via the Capital Gains Tax Exemption.

This amount increases to 500000 if youre married. Not All Profits Are Taxable. Individuals and families must pay the following capital gains taxes.

Mom buys the house in 1980 for 10000. A capital gains tax is a tax you pay on the profit made from selling an investment. Florida has no state income tax which means there is also no capital gains tax at the state level.

Senior Exemption Information The property must qualify for a homestead exemption.

The States With The Highest Capital Gains Tax Rates The Motley Fool

Do You Pay Capital Gains Tax On Property Sold Out Of State

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Can You Avoid Capital Gains Taxes When Selling A Second Home Upnest

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Estimated Tax Penalties For Home Resales

How Capital Gains On Real Estate Investment Property Works

How High Are Capital Gains Taxes In Your State Tax Foundation

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

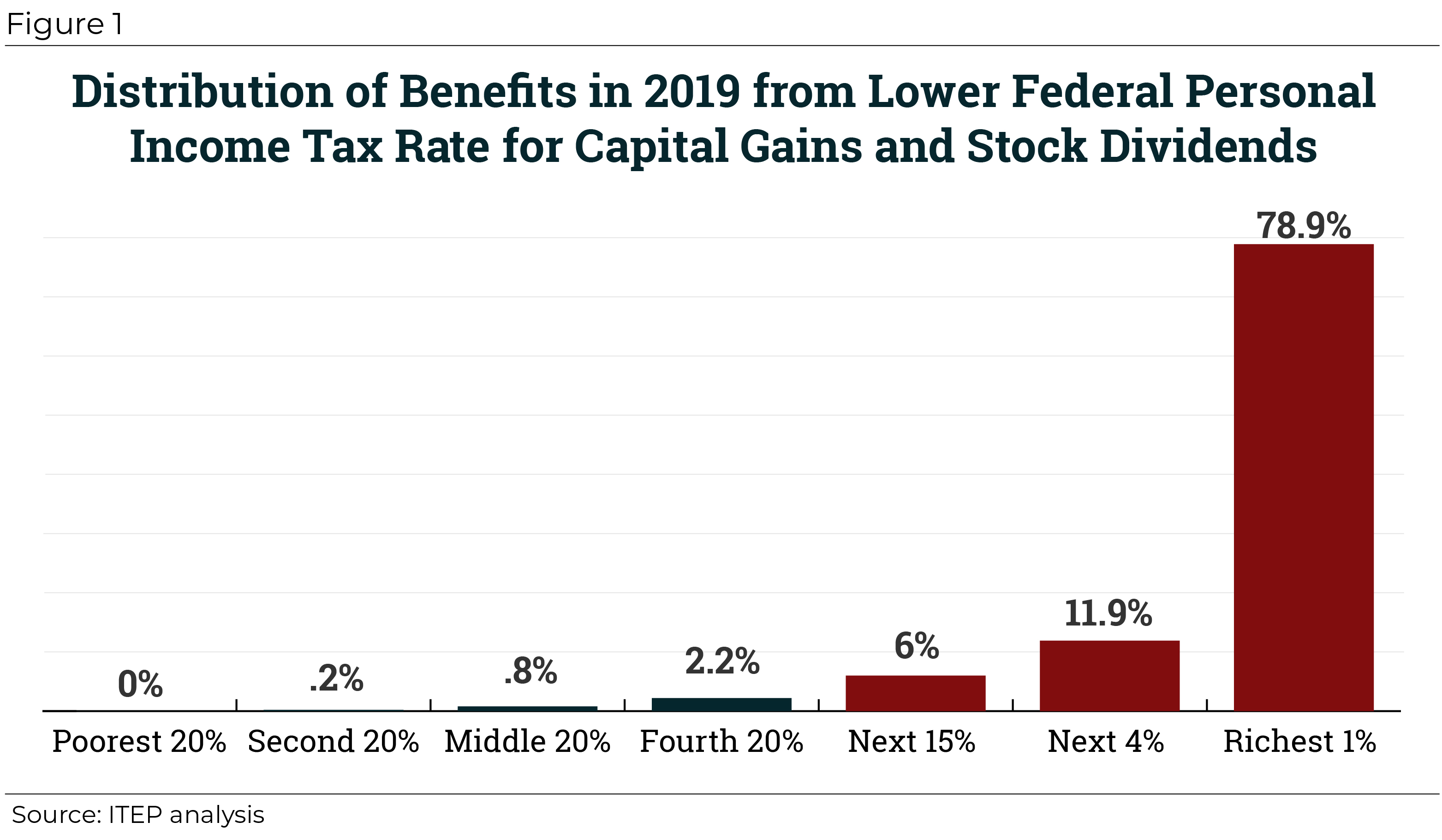

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

The Preferential Tax Treatment Of Capital Gains Income Should Be Curbed Not Substantially Expanded Itep

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group